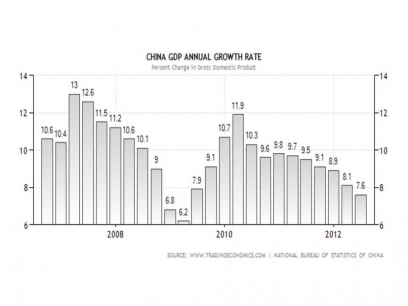

What goes up must slow down

China’s upward trajectory economy has defied gravity for some years but there are real signs that the economy is starting to change. Of course China famously reduced its growth forecast to around 7,6-8% from 9 something last year, but even so, 7-8% growth is still phenomenal by any means. But now there are various small but important signs starting to emerge which signal that life will start to get increasingly difficult both for individual Chinese companies and its economy.

First to look at the macro factors, China’s economic growth is currently on a continuous downward slope (see the chart alongside Source: http://www.tradingeconomics.com/china/gdp-growth-annual), and at its lowest since growth 2009. Whilst this is not the first time to see a slowdown in growth, the question is “are there structural difference between now and 2009 when China’s growth rebounded?” The answer is yes, but unfortunately the structural differences are not positive for China, the main points being:

- Inflation in China compared to the rest of the world: Whilst true wages in China are clearly way still below Europe and US, China’s costs are increasing rapidly whilst labour cost inflation in developed countries declines and costs in other developing countries start from a lower base than China and become the new attractive labour markets. A major new report by PwC (‘Homecoming for US Manufacturing?’)[i] estimates China’s costs are expected to rise over 80% over the next four years compared to around 10% for the US. In the example of steel, studied by PwC, the report concludes that overall it is now cheaper for US manufacturers to manufacture steel in the US than in China, so the advantage of offshoring to China from developed countries is now no longer as clear cut as before. At the other end of the scale, in other low wage industries for example textiles, China is no longer considered to be a truly low cost country is now considered as being expensive compared to other countries like Vietnam, Africa and so on. So China risks to be squeezed between repatriation of manufacturing back to developed countries on the one hand and emerging low costs labour markets on the other

- Ecomonic slowdown. As we said, 8% is impressive growth, but nevethless parts f the economy are starting to feel the pinch. For example even car sales are slowing drastically as Caixin news service reports[i] “"For some car brands, we have inventories on hand of up to four months worth of sales," Pang Qinghua, chairman of Pang Da Automobile Trade Co. Ltd. said. "The normal stockpile lasts for one and a half months.". Inventories of 400 dealerships around the country in June were up an average 22.24 percent compared to the figure for January with "The situation for car dealers (being) worse than during the global financial downturn in 2008," according to Li Yan of Pang Da Automobile.

- Political uncertainty: For many years the political and geo political situation has at last been relatively benign and stable, but that is looking less so as the current wobbles over leadership, combined with the issues like the row with Japan over the Diaoyu Island which is raising political and trade tensions with Japan, demonstrations on the streets and images of Chinese citizens smashing up Japanese cars or audio equipment does nothing to build business confidence with foreign companies or governments, and if they continue or increase, foreign businesses will inevitably review their investment and trade decisions. Other factors like growing resistance to one child policy, displaced agricultural workers, increasing inflation, continuing corruption concerns, etc cast a cloud over future prospects

- Growth issues of indegenous Chinese companies: Chinese companies have benefitted enormously up to now from both global and local demand growth, but as Chinese economic attention shifts to developing organic consumer-led growth and hypergrowth slows , Chinese companies are not well positioned to exploit opportunities outside of the mainland. BCG have in fact recently published a report entitled “The End of Easy Growth” [ii]a report into the global challenges faced by Chinese businesses. Amongst the many interesting findings and conclusions of this report, BCG makes some interesting points:

-

Whilst the domestic growth opportunities have been enormous for Chinese companies, hypergrowth is over and indigenous companies may have been distracted during this period from (and are therefore not well positioned to exploit) opportunities overseas

-

The nation’s costs advantage is shrinking as labour and other inputs rise with manufacturing labour costs expected to rise at least 10% annual between 2012 and 2016, five times as fast a developing markets such as Thailand and Vietnam

-

Whilst Chinese companies and strategic industries have long enjoyed support and protection from government, multinationals have had to learn and adapt to get better at competing against Chinese companies

The BCG conclusion is that few companies have established a truly world class capability and skill set. All of this should give encouragement to western businesses who thought that the growth of the Chinese competitors was irresistible. History teaches us that no empire lasts for ever. Science teaches us that gravity pulls everyone back to earth no matter how strong they are. Even China it seems, cannot avoid these simple laws and the onward march of Chinese products and companies is by no means self evident.

[i]http://english.caixin.com/2012-09-20/100440455.html

[ii]https://www.bcgperspectives.com/content/articles/globalization_2012_chinese_global_challengers_end_of_easy_growth/

[i] Page 5 of Homecoming for US Manufacturing?’ at http://www.pwc.com/us/en/industrial-products/publications/us-manufacturing-resurgence.jhtml

Posted on: Monday, September 24, 2012